130+ Currencies

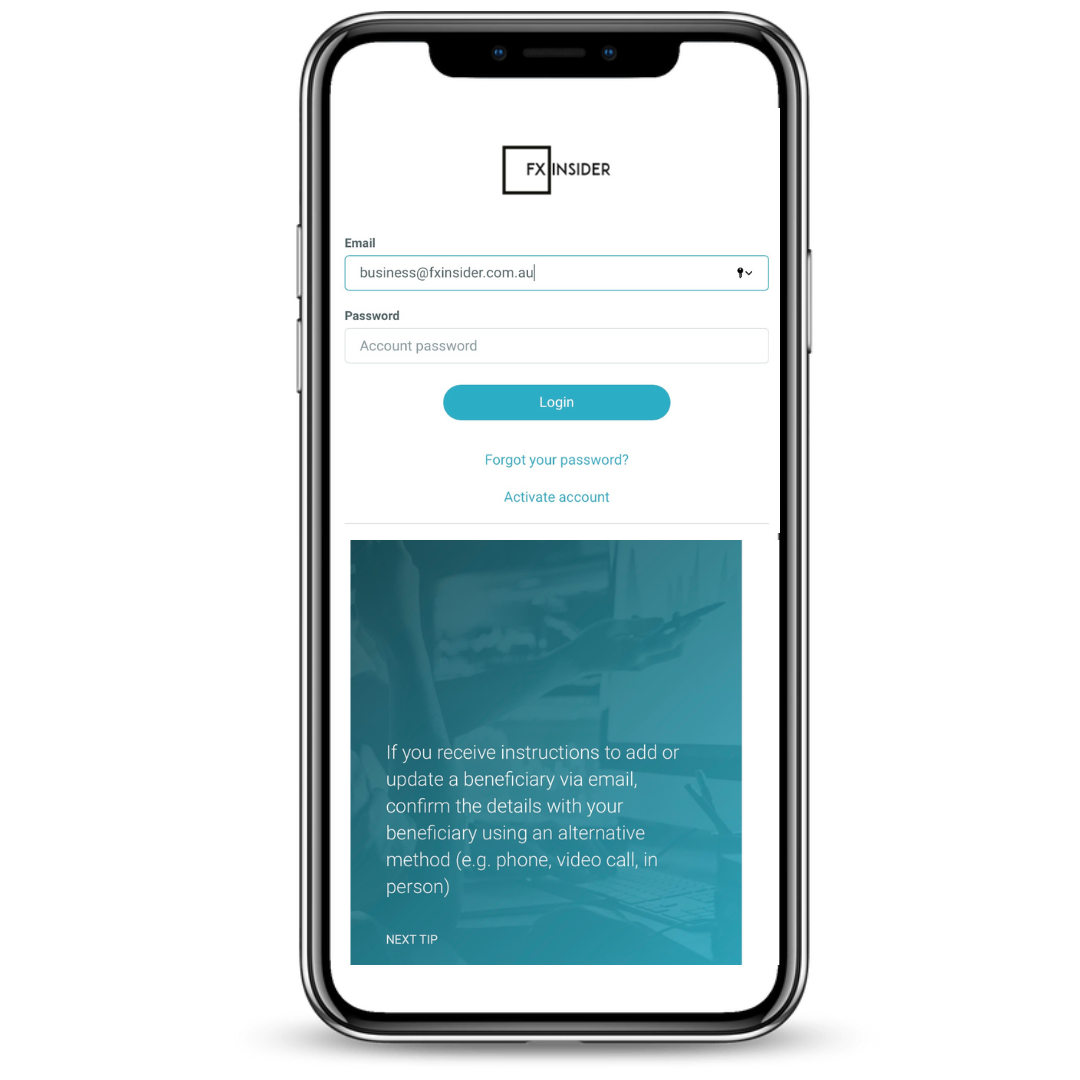

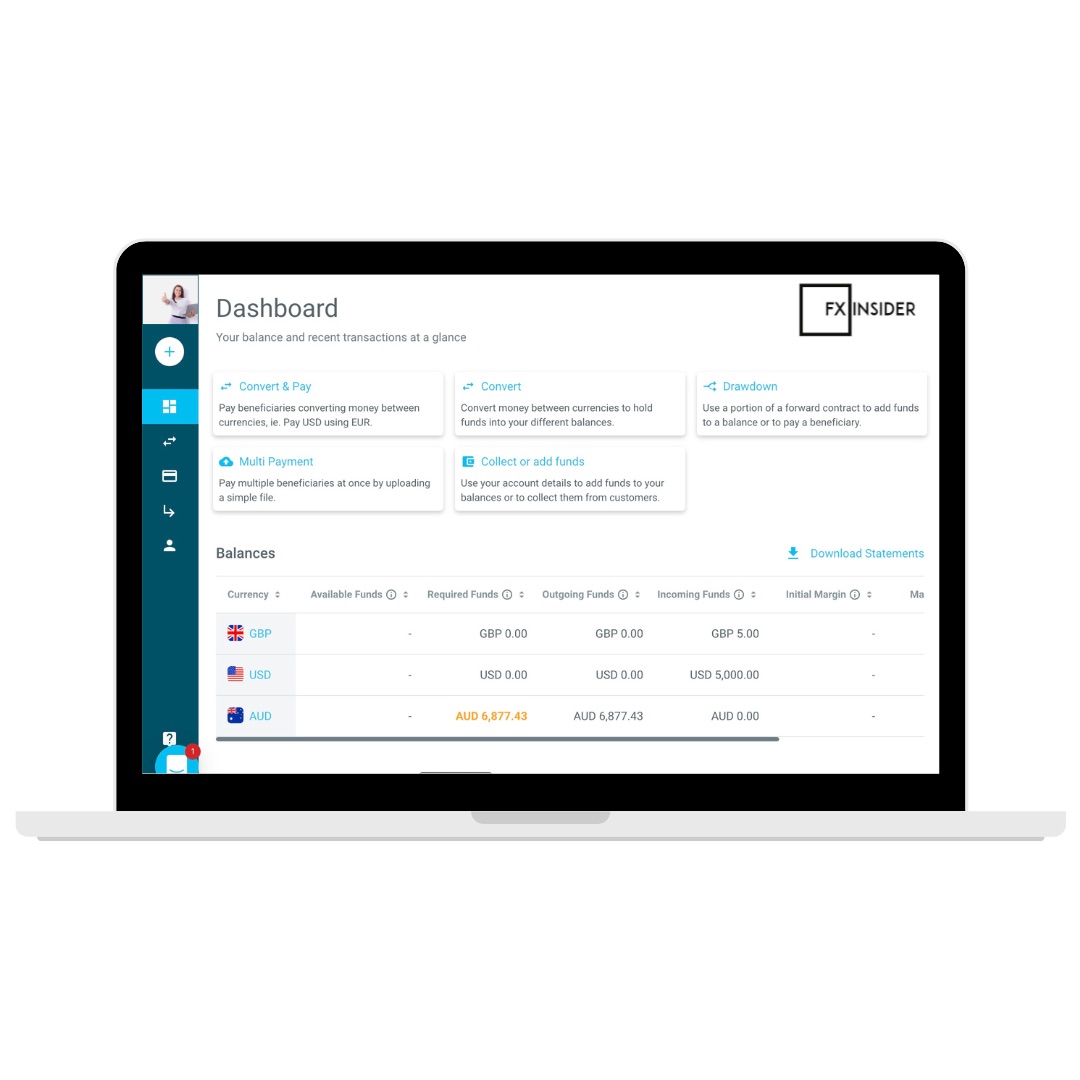

FX ONLINE Portal

Local Currency Accounts

35+ Currencies

FX Risk Management

Manage Your FX Risk

Trade Finance

Access Working Capital

FX ONLINE

FX Online provides a simple and secure method of sending international payments to approved beneficiaries as well as managing foreign exchange risk for your business. Our global payment solutions enable you to efficiently and securely send payments across the world in over 130 currencies.

- FX Payments

- FX Risk Management

- Currency Accounts

- Trade Finance

FX Dashboard

Access live competitive FX rates when paying overseas suppliers. Make and receive payments in major and minor currencies. Manage and track all of your payments on your own devices, create simple spot transactions or upload an invoice to extend your credit terms with your suppliers up to 150 days T&Cs apply.

- Access currency balances 24/7

- Upload an invoice to finance your purchase

- Create over 100 payments through a file upload

Personalised Style

We will work together with you to understand your FX needs and develop a tailored strategy for your business- helping you stay ahead of the impact of currency volatility on your business.

Market Orders

Flexible with your transfer date and time? you choose a target rate at which you want to purchase or sell currency. When the market matches your target rate and the order fills. An FX specialist will contact you to settle the transaction.

Forward Contracts

Secure a forward exchange rate now and use it for future international payments. A Forward contract can help protect your business against unfavourable exchange rate movements, these movements can have implications for any business that has receipts or payments in foreign currency.

Non-Deliverable Forwards

When there are regulatory limits - in the absence of a local forward market, or when there is limited foreign access to local currency markets. NDFs are a way to hedge exposure in currencies where a conventional spot or the forward market does not exist or is restricted.

Participating Forwards

The participating forward protects you by providing you with a protection rate, like a Forward contract. However, it allows you to partially participate in any favourable exchange rate movement. Other structured transactions like Foward Extra & Range Forward are also available with leveraged and non-leveraged.

FX Options

We help you create a currency hedging program that is effective and efficient then develop a strategy that protects budget levels, reduces FX exposure, and enhances participation in favourable moves through a combination of FX options and custom structured Forward transactions.

Trade Finance &

Foreign Exchange

- Access Tradeline up to $5M AUD

- Pay overseas & Domestic Suppliers

- Manage your Trade Finance via FX ONLINE

- No Establishment fees & No Transaction Fees

Funding Period

150 days from the date the invoice is paid, minimum term of 30 days.

Pricing

From 0.3% to 1.5% p.m depending on risk profile and credit rating.

Cost

Charged for the line amount used, and no fees for not using the line or early repayments.

Security & Control

No tile over your goods, no property security.

Looking for a personalised Foreign Exchange Solutions?

- 100% account managed relationships

- Personalised FX trading support and advice

- We take time to learn and understand your business ensuring outstanding performance every time you deal in cross border payments

Market-leading FX Rates

Access live competitive FX rates when paying overseas suppliers.

Trade Finance

Access up $5M AUD working capital to pay local and overseas suppliers.

FX Hedging

Secure your FX rates now and use them anytime in the next three years.

API

Reduce your manual workload by automating the payment process. Enable real-time FX dealing and hedging.