Purchasing Power

►Extend payment terms up to 150 days

►Access tradeline from $100,000 to $5million

►Pay overseas and domestic suppliers

►Manage your trade finance through FX online

trade finance

01.

working capital

You receive an invoice from your supplier that needs to be paid in 30 days. We offer quick, secure and direct payment to your supplier in their local currency.

02.

transparency

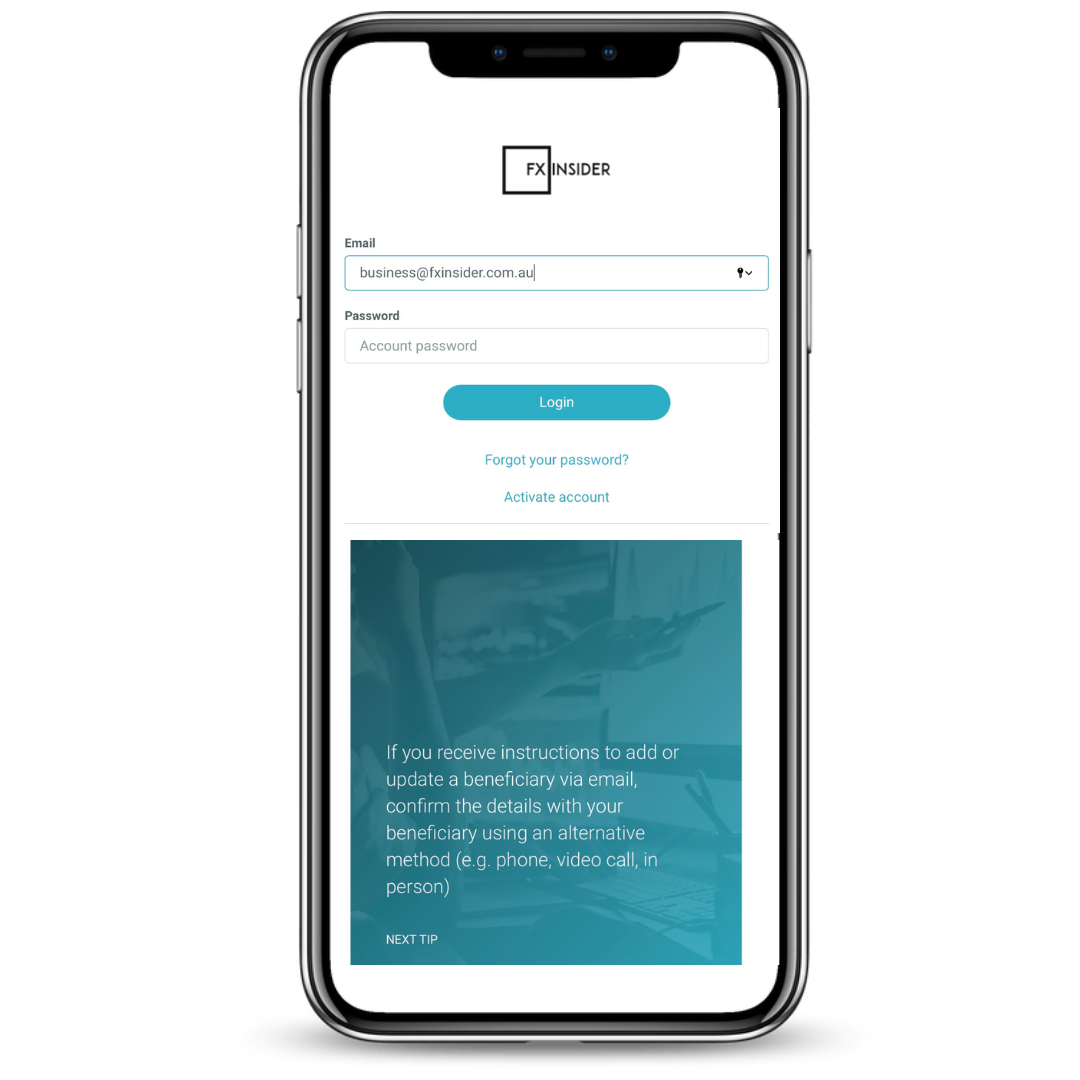

You upload an invoice online and we pay your supplier straight away in any currency. Manage your Trade Finance process from start to finish through FX online, with 24/7 access to account balances and available funds.

03.

Flexibility

No contract so you can choose invoices you want to pay. Only charged for the line amount used, and no fess for not utilising the line.

04.

Credit terms

You receive funds for your goods and services. You have the option to repay us back up to 150 days later in your local currency, with no extra fees for early repayments.

Unsecured line of credit from

$100,000 to $5,000,000

Facility Type – Trade Finance Unsecured Line of credit

Funding Period – 150 days from the date the invoice is paid, minimum term of 30 days

Cost– Charged for the line amount used, and no fees for not using the line or early repayments

Fee – No Establishment fees, no transaction fees, no unutilised line fees or exit fees

Security – Totally unsecured. No title over goods, no property security

Pricing– from 0.3% to 1.5% p.m depending on risk profile and credit rating

Growth

Gain access to a revolving line of credit to pay both domestic and international suppliers in over 130 currencies with market-leading FX rates and Risk management tools all in one platform.

Purchasing power

Pricing from 0.3% – 1.5% per month depending on the currency and the risk profile. Trade Finance provides you with up to 150-day credit terms, allowing you to set your own payment terms and close the funding gap, empowering your business to scale and grow.

real relationships

- Pay your suppliers early, partner with them for the long term

- Opportunity for Early Payment Discount with suppliers

- No conflicts with existing banking relationships

Trade Finance Starter Pack

Get all the information you need emailed to your inbox.

access 90% of your

invoices now

Invoice finance

Improved Cash-flow

Being able to access funds tied up in unpaid invoices so quickly puts your business in a better position to cover company expenses and capitalise on new opportunities.

Extend payment terms

Invoice finance allows your business to extend payment terms to your buyers with confidence, not having to worry about the detrimental impact on your cash flow.

Accelerated grwoth

The credit line is based on the value and quantity of your invoices, the funding you can access increases together with your revenue.

Control and Security

There is no collateral in place or assets as security to set up an invoice finance agreement. Just send us an invoice and access up to 90% of your invoices within 24 hours.

Invoice finance

01.

Business as usual- make the deal

You sell your goods or services to another business – a customer. Some customers can take up to 60 days to pay the invoice.

02.

manage the process through fx online

You upload the invoice onto FX online platform at your selected frequency. We make up to 90% of the invoice value available on FX online and are ready to be utilised within 24 hours.

03.

Buyer credit- up to 120 days

Your business will receive 90% of the invoice straight away, with your buyers repaying you when the invoice is due. You now have the power to extend your buyers credit up to 120 days.

04.

receive remaining balance

We pay you the remaining balance of the invoice less any interest.